Operational Models and Educational Debt in ATS Seminaries

Why do we care? What do we know? What can we do?

How Much Debt Is Too Much Debt?

Often times, the challenges we face and the opportunities they create are multifaceted. The fact that large numbers of seminarians are taking significant amounts of educational debt with them when they graduate is no exception. In a recent research project that was part of the Lilly Endowment’s Economic Challenges Facing Future Ministers initiative, Dr. Harriet Rojas and I found that theological education may need to address areas related to operations, educational models, market awareness, and curriculum if it is to have any impact on student debt.

One area that needs to be addressed is the process we use for awarding federal loans. Whereas we cannot control the amount of loans a student requests while attending our respective schools, we believe we can control and improve two important aspects of the process: 1) the information that we provide during the financial aid process and 2) how we calculate the Cost of Attendance.

The Information We Provide

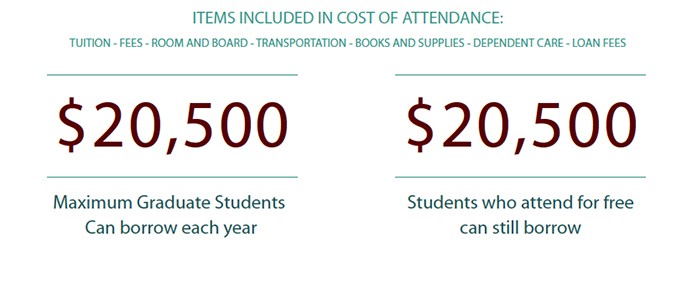

I have personal experience in talking with students who are going to use loans to pay for their education. In my conversations, it became clear that I only had so much influence in a student’s decision regarding loans. Given that reality, it is important for us to be clear in our communication. The simple reality is that the charts or tables we use to show compound debt or totals to be repaid often confuse or bore students, which means they may tend to ignore anything we put in front of them. As a result, despite our encouragement to take fewer loan dollars, students often request the maximum possible, which is currently $20,500 per year. During a previous research project, Dr. Rojas came across a set of metrics that succinctly defines how much debt is too much. We believe these metrics are good conversation starters when counseling students.

When talking with students, ask them to consider the fact that a student has, or is requesting, too much debt when:

• The aggregate student loan debt is more than the anticipated annual salary.

• The student’s monthly loan payments exceed 10% of their net monthly income.

• The student cannot find employment in the area of study.

• He or she does not live within his or her means (the student cannot continue to borrow to pay off student loan debt).

Unfortunately, the first two of the four items are often true for students who will be engaged in ministry.

How We Calculate Cost of Attendance

Aside from helping students consider the amount of money that they are requesting, one of the practical ways that we can have an impact on the amount of money students borrow is by adjusting the Cost of Attendance at our respective institutions.

Cost of Attendance is a technical term in the work of Title IV student loans. It refers to the amount of money a school believes a student will need in order to attend the school in question. What many schools may not understand (or have not been willing to consider) is that we have ultimate control over that amount so long as we are consistent across our programs.

The federal government provides a list of allowable charges for the Cost of Attendance. Many schools include in the Cost of Attendance calculation, annual tuition costs, food and lodging costs, transportation costs, etc. Often times, the Cost of Attendance is calculated in such a way that even students receiving a full-tuition scholarship to attend seminary could still borrow $20,500. Such calculations give students access to the maximum amount of loans despite the fact they may not need that much money. This practice is somewhat understandable in undergraduate programs where there is a possibility for grant funding or larger amounts of federal work study opportunities. However, for the most part, federal grants for students enrolled in seminaries do not exist, so the entire cost of attendance is funded by unsubsidized loans.

Think about that for a moment. A student with a 100% scholarship could still walk away from seminary with over $80,000 in debt if he or she borrows the maximum each year. We may think this is irrational, but it happens on a routine basis across North America.

One way to change that reality is to find a way for our schools to have a Cost of Attendance that is as low as possible. For instance, one school in our study decreased the amount it included for living expenses because most of its students were adults and were expected to have a job or some other source of income. In doing so, this school was able to decrease the maximum amount students could borrow. The average student enrolled in seminary in North America is similar to those enrolled in this school.

We walked away thinking, “If we have the freedom to decrease the amount we include for housing, transportation, food, etc., then why are we not doing exactly that.” What if the largest single amount included in Cost of Attendance was the cost of tuition rather than all the other things we tend to include? In doing so, we could create a hard cap on what students are able to borrow. If that were coupled with a concerted effort to decrease the amount we charge for tuition, the result would be rather profound.

Conversation and Caps

It seems that the amount students are borrowing is more a function of our ability to communicate clearly in our conversations and our willingness to adjust our Cost of Attendance calculations. As we pointed out in earlier posts, there is no correlation between cost of tuition at a school and the amount of debt students at that school incur while enrolled. The fact that students can borrow $20,500 per year even with a 100% tuition scholarship sheds some light on why no correlation exists. Our Cost of Attendance calculations may be enabling students to borrow more money than is necessary. In essence, we are increasing access to credit, which is something that often results in more debt. In fact, as we will soon point out, this is exactly what happened in higher education. We will look at that sad reality in two weeks. But first, next week’s post will look at a glaring omission in our curricula.